Gift Tax

In this text we will explain to you what a gift is, when you are supposed to pay gift tax in The Netherlands and what the exemptions are for gift taxes.

Gift

Gifts are an agreement where those who give the gift are contributing to the capital of the party receiving the gift at their own expense. The party donating does not require anything back for their gift. In other words, this means that someone gives money to someone else. When we can speak of impoverishment for the party donating, then the gift is not taxed. This means that the capital of the donator will reduce because of the gift.

Claim

A gift can only be legally seen and claimed as a donation when the party receiving the gift has received the gift.

Waiver

When a loan is waived, it is also a matter of a gift for which the donator diminishes their own capital. Waiving a loan or a settlement agreement that leads to a donation are also taxable.

Gift tax

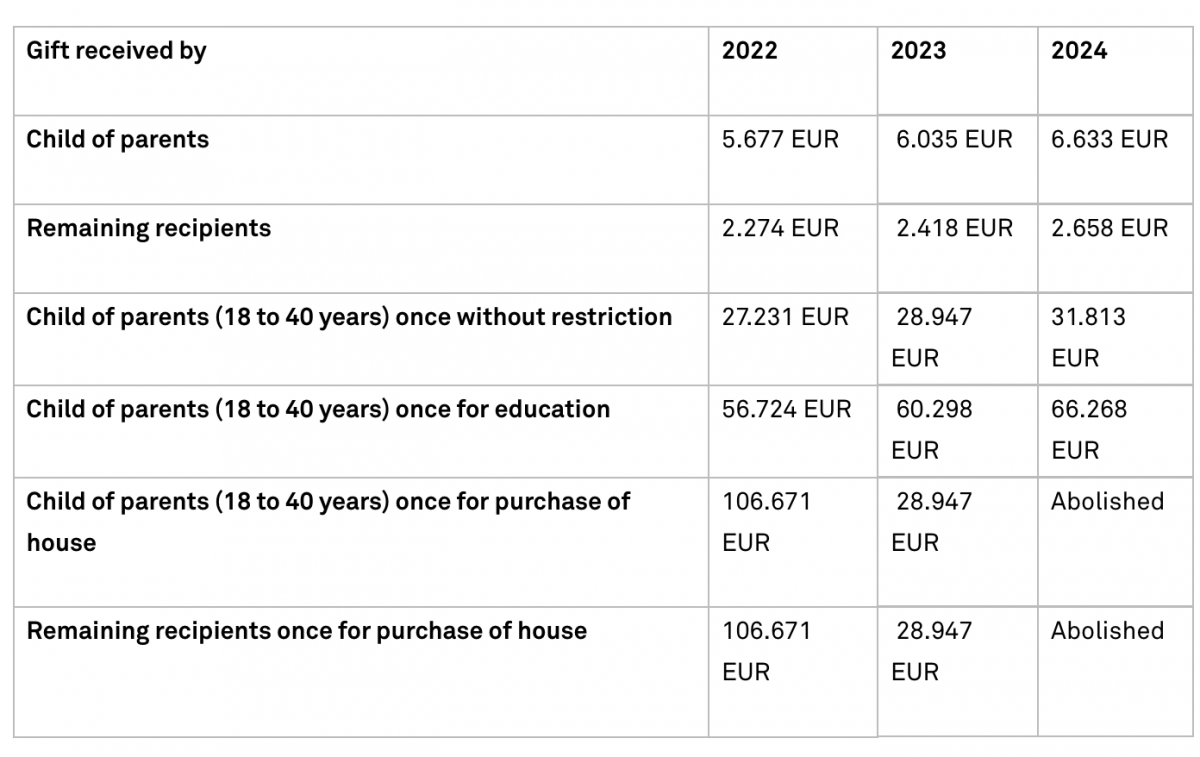

Certain exemptions apply for gifts. The exemptions are included in the table below. When the gift is higher than the donation, you are owed gift tax to the Tax Authorities over the amount that is higher than the exemption. In the table below, the exemptions are included.

2023: abolition of so-called Jubilee-tonne and tax-free gift for purchasing of a house

Donating a 'jubilee tonne' - a tax-free gift of a bit over a € 100.000 for mortgage costs - would favor first-time buyers in the housing market who are financially supported in this way. In order to promote equal opportunities for starters, making such a high tax-free donation, will no longer be possible from 2023.

As of 2024, the Tax and Customs Administration will take another step in this direction and the tax-free gift for an owner-occupied home has been completely abolished. Parents can, of course, give their child(ren) the one-time free amount to be spent tax-free, for the purchase of a home.

Would you like to know more?

When you want to make a gift with as many benefits as possible, you can create a gift plan. The ins and outs of a donation plan, you can find here. The Tax Authorities website (in Dutch) has the most recent rules in regard to (tax-free) donation. Do you have questions about a gift? Please feel free contact us (see below).