Bugdet day 2024: News for entrepreneurs

During the presentation of the new cabinet’s budget memorandum on ‘Prince’s Day’, various proposals for tax reforms were put forward once again for entrepreneurs. Although the proposed reforms still have to be approved by the Senate and House of Representatives, the plans give an idea of what you can expect from 2025 onwards. In this article Moneywood outlines the most important tax reform proposals you need to be aware of as an entrepreneur.

Box 2: substantial interest

Are you a substantial interest holder and is your income from a substantial interest more than € 67,804? Then you could be eligible for income tax benefits. The government proposes to reduce the 2nd bracket of box 2 from 33% to 31% as of 2025. This should create a better balance between the tax rates in box 2.

Dividend withholding tax buyback facility

The governments earlier proposal to abolish the dividend withholding tax buyback facility as of 2025 will be scrapped. The repurchase of shares by a listed company will remain exempt from dividend withholding tax under certain conditions under the new tax reforms.

Deductions and corporation tax

During Budget Day, it was proposed that the limitation on the deduction of interest for companies be relaxed. The threshold for deductibility of interest in corporation tax is now a maximum of 20% of the profit. The government proposes to increase this percentage to 25%. If the generic interest deduction limitation is extended, companies will be able to deduct a larger part of the interest from their profits and therefore have to pay less tax on it.

Changes have also been proposed for corporation tax with regard to the deduction of donations: While donations to charities with an ANBI or SBBI registration are currently still deductible from corporate income tax, the government wants to end this scheme as of 2025. From then on, these gifts would be taxed as a profit distribution. Sponsorship of charities remains deductible, and donations remain deductible for income tax purposes.

Business Succession (BOR)

The government proposes to amend the rules for tax on business transfers. For the sake of practicability and to limit abuse, it has been proposed to shorten the continuation period of the BOR to 3 years as of 2025. Currently, the term is 5 years. As of 2026, additional measures regarding succession and donation of companies have been proposed. You can read in this bill what they are (in Dutch).

VAT rates

During Budget Day, the measure from the outline agreement to increase the tax rate on leisure, culture, books and sports was restated: the VAT rate for culture, books, sports and overnight stays will increase from 9% to 21% by 2026. Bookings made in 2025 for activities in 2026 will also be subject to the higher rate. In addition, an increase in the rate of gambling tax has been budgeted for the next two years. From 1 January 2025, it will gradually increase from the current 30.5% to 34.2% then rise to 37.8% in 2026.

(Business) transport

Several tax reforms relating to cars and transport have been included in the tax plans presented on Budget Day. As a (business) director or entrepreneur in the automotive industry, you may be effected by the following changes:

- MRB (road tax)The government wants to give emission-free passenger cars (both new and second-hand) a 25% discount on road tax until 2029. This discount should compensate for the extra weight of the battery; After all, the amount of road tax depends on the weight of your car. This discount scheme will expire in 2030.

- Bpm (purchase tax)

Are you planning to buy or sell a plug-in hybrid car in 2025? The government plans to abolish the separate Bpm rate for these vehicles. The price per gram of CO2 emissions will then be the same as for other passenger cars.

- Excise duty (petrol, diesel and LPG)

The government plans to continue the current excise duty reduction on petrol, diesel and LPG in 2025. Inflation correction measures will not be applied. For example, the excise duty rate will remain the same as in 2024: Petrol € 0.79, Diesel € 0.52, LPG € 0.19) per litre.

Low Income Benefit (LIV)

Do you employ staff and do you make use of the LIV scheme? The LIV is expected to expire on the 1st of January 2025. You will no longer be able to use this benefit.

Energy taxation

Regarding the energy sector, the proposed 2.3% increase in energy tax on natural gas will not go ahead. Instead, the government proposes to reduce the tax as of 2025, making the tax 2.8 cents per m3 lower than without this measure (up to a maximum of 170,000 m3).

Want to know more?

In November and December, the House of Representatives and the Senate will vote on the reforms mentioned above. At the end of the year, the final Tax Plan for 2025 will be announced. Of course, Moneywood will keep you informed.

Would you like to learn more about the upcoming tax measures? On this page you will find the 2025 Tax Plan and all related documents (in Dutch).

Are you wondering what other changes might effect your business? The Chamber of Commerce's entrepreneurs' square has set up a page with all proposed legislative changes (in Dutch) that may have consequences for entrepreneurs.

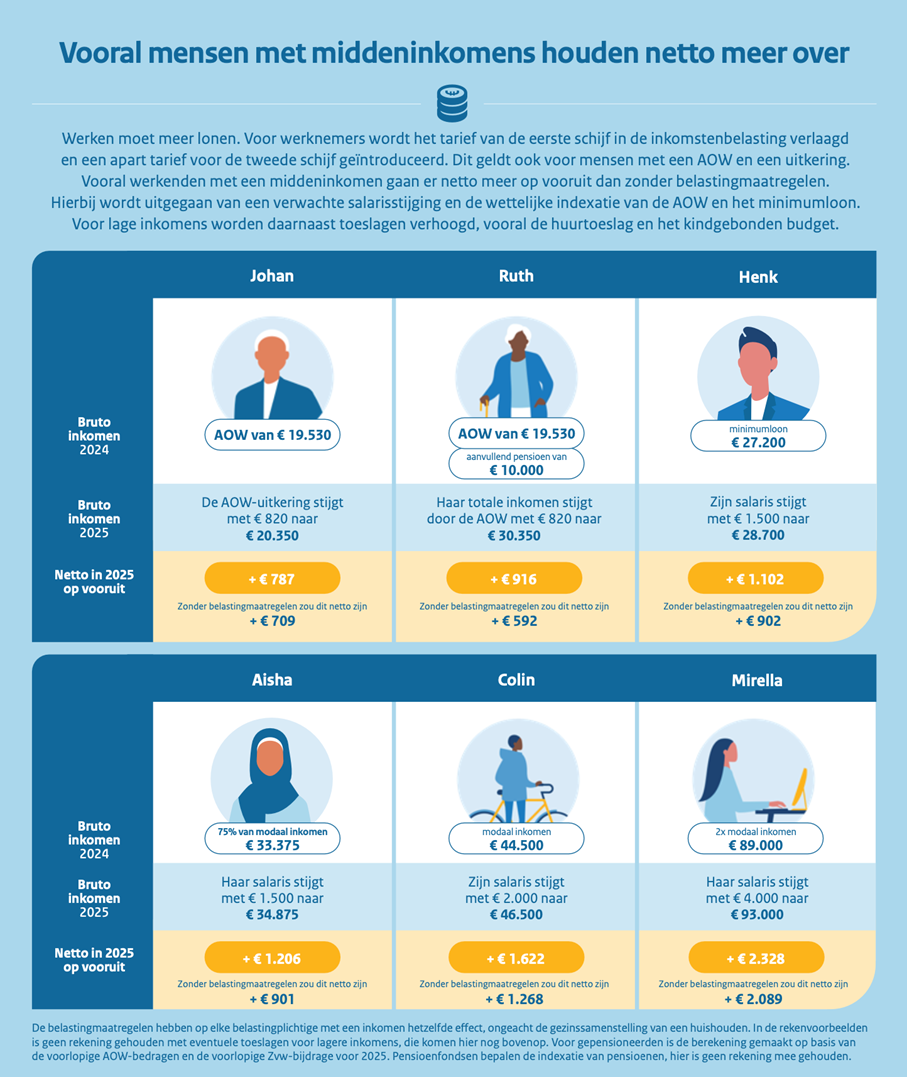

Below you can see a number of practical examples of fictitious entrepreneurs and the tax increases they could face in 2025. This will give you an insight into what you can expect if the plans are approved.