Form 1040

Virtually all U.S. citizens are obliged to file a U.S. tax return, regardless of where in the world you currently live. The IRS (Inland revenue service) begins accepting federal tax returns from U.S. citizens in earnest, annually at the beginning of February. If you’re a U.S. citizen at home or abroad preparing your annual income tax return, you undoubtedly have many questions over Form 1040. In this article we have put together some information you may find useful when the U.S. tax season begins.

What is Form 1040?

Form 1040 is issued by the (IRS) and is the primary means U.S. citizens at home or abroad must use when filing their annual income tax return. Form 1040 allows taxpayers to report their total income and their taxable income after deductions. The information you provide on Form 1040 will be used to determine how much tax you must pay, or whether you are eligible for a refund. The number of variants of Form 1040 has been reduced in recent years for simplicity. There are currently three variants of Form 1040, plus Form 1040 X. Listed below are the form variants and there uses.

- Form 1040: This is the most common form and is used by most taxpayers, either employed or self-employed;

- Form 1040 SR: This variant is provided for senior citizens (age 65 or older). The print on this variant is larger for ease of reading, and it comes with a handy chart to help calculate the taxpayers standard deduction;

- Form 1040 NR: This variant is for non-resident aliens or NRA’s. Individuals who are not U.S. citizens and have no green card but earn an income from the U.S. can file this form;

- Form 1040 X. This variant can be used to amend or correct a previously filed tax return.

Depending on the types of income you wish to declare, it may be necessary to complete a number of attachments known as schedules. For example, schedule C can be used to report profits or losses from a business or company where you are the sole proprietor. Filing Form 1040 and associated schedules can be extremely complex, and we highly recommend consulting a tax professional. Complete information on filing Form 1040 and associated schedules can be found on the IRS website. Form 1040 is available (here) on our handy forms page.

Common Attachments

Below is a list of standard forms which are commonly filed alongside Form 1040.

- Form 2555, or foreign earned income exclusion form, can be used to claim an exclusion for income earned abroad;

- Form 8938, statement of specified foreign financial assets;

- Form 1099-R, is used to report funds from retirement plans, such as an IRA or 401(K);

- Form W-2, is used to declare your salary and taxes on that salary;

Form 1099-DIV, this attachment can be used to declare dividends or distributions received from investments.

Who must file Form 1040?

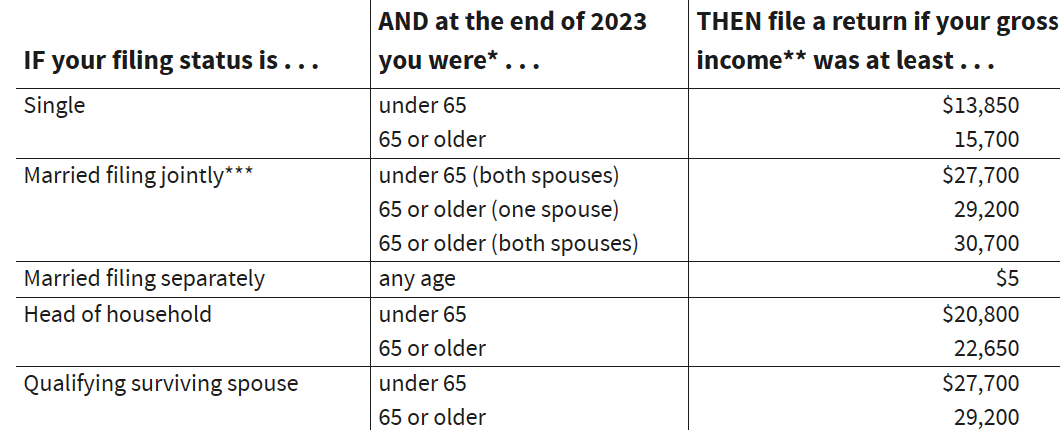

The IRS requires all U.S. citizens to file individual income tax return Form 1040 regardless of where they live, if their income exceeds the prescribed thresholds. Your individual status is used to determine the filing threshold for your gross income as follows:

Self-employed?

Self employed people are also required to file Form 1040 if their net earnings from self-employment exceed $400.

Benefits

In some cases, even if you don’t exceed the relevant thresholds for filing U.S. tax return Form 1040, filing may still be beneficial as you may be eligible for a tax refund or certain tax benefits.

Form 1040 filing deadline

For the majority of U.S. citizens Form 1040 must be filed by April 15th. Expats however are granted an automatic extension until June 17th, in some cases a further extension until October 15th can be requested. Please note an extension on the filing date is not an extension to pay. Taxes due must be paid by the April deadline to avoid any potential penalties.

Penalties

Its essential to file Form 1040 accurately and on time in order to avoid what can amount to severe penalties. For instance, a standard penalty of 5% of your unpaid taxes per month will be incurred for every month that your tax return is overdue, up to a maximum penalty of 25% of your taxes owed. Tax returns that are more than 60 days will incur a minimum failure to file penalty of $435 or 100% of your unpaid taxes.

Completing individual tax return Form 1040 alongside the relevant schedules and attachments is a notoriously complicated process, even minor mistakes could have serious consequences for your tax bill. We strongly recommend consulting with a tax professional before attempting to complete this Form on your own.

Further information

Complete instructions on how to complete and file Form 1040 are available here on the IRS website. Form 1040 can be downloaded (here) in pdf format. In this article, Moneywood discusses some of the benefits and challenges, for entrepreneurs here in Holland. Alternatively in our article Paying taxes in the Netherlands, we have provided an overview of the tax system in the Netherlands, and how it can work for your business. If you have questions or need advice when submitting Form 1040, here at Moneywood our experts have many years of experience supporting our valued U.S. expat community when tax season comes around. Please don’t hesitate to contact us. We are here to help.