Deduction

Tax credits in income tax

A tax credit is an amount that reduces your income tax over a year. In your income tax return, you indicate that you meet the conditions of a discount. There are different tax credits and not all discounts apply to everyone. The discount amounts change every year. Below we have made a list of the different tax credits:

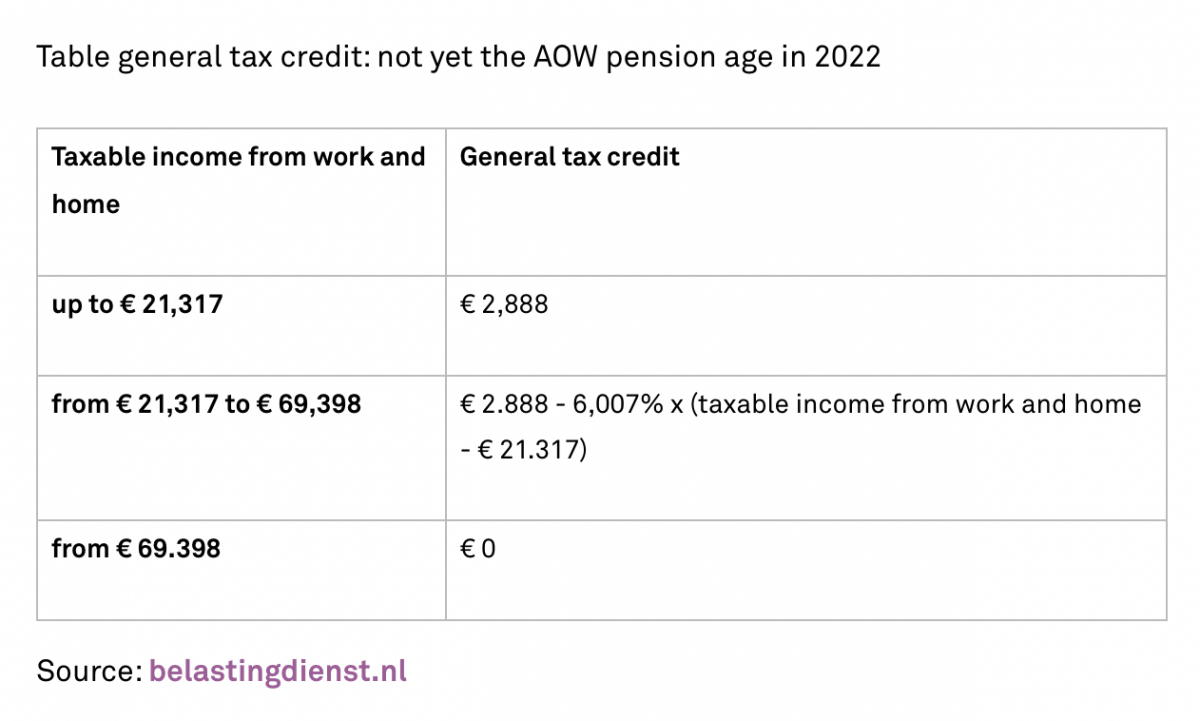

General tax credit

Everyone who files an income tax return is entitled to the general tax credit. The discount is income-dependent and amounts to a maximum of € 2,888 in 2022:

Table general tax credit: not yet the AOW pension age in 2022

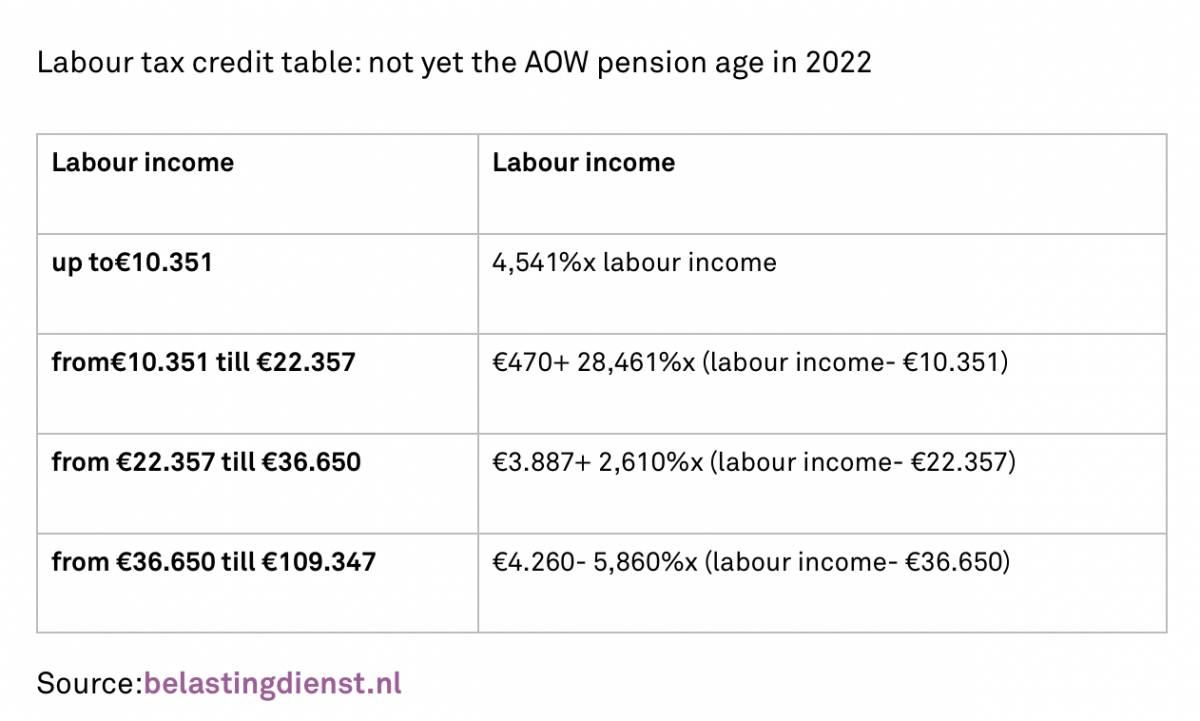

Labour tax credit

You are entitled to the labour tax credit if you perform paid work (wages from employment, profit from business, freelance income, etc.). The labour tax credit is an incentive to work and for older people to continue working longer. The labour tax credit is calculated on your labour income. The amount of the labour tax credit is income-dependent.

Labour tax credit table: not yet the AOW pension age in 2022

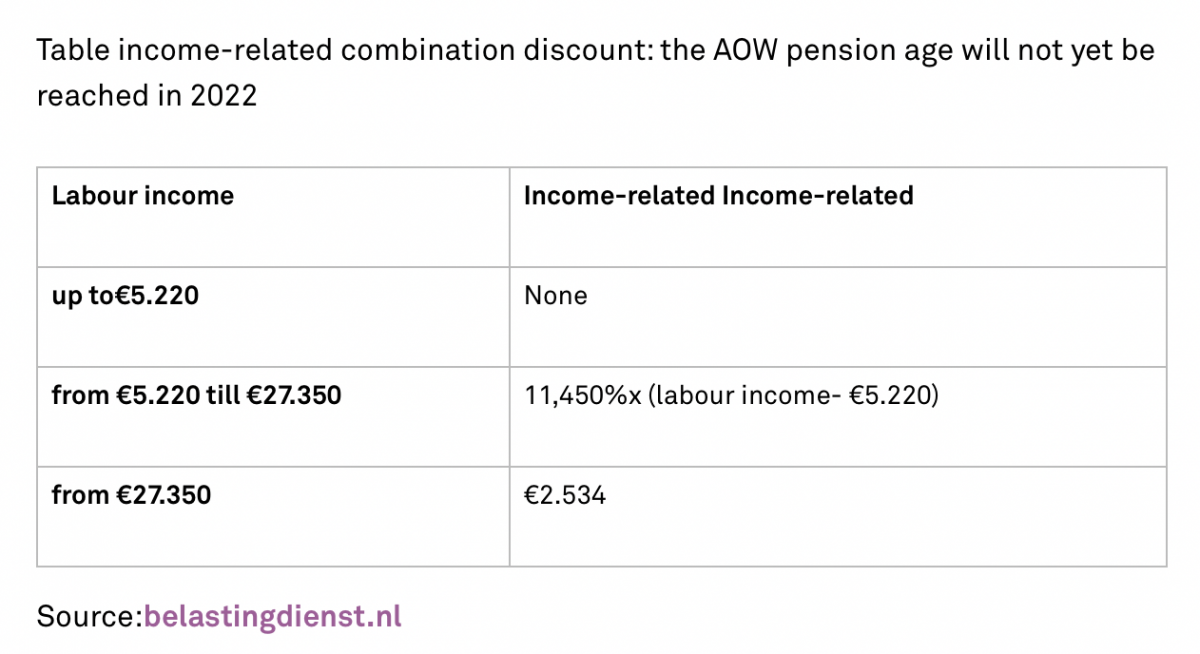

Income-related combination discount

If you work and have children, you may be able to make use of the income-dependent combination discount. In 2022, the discounts will be as follows:

Table income-related combination discount: the AOW pension age will not yet be reached in 2022

To be eligible for the income-dependent combination discount, you must meet the following conditions (2022):

* For more than six months of the year, a child under the age of 12 belongs to your household. With co-parents, the child may also be registered at the home address of one of the co-parents.

To be eligible for the income-dependent combination discount, you must meet the following conditions (2022):

* For more than six months of the year, a child under the age of 12 belongs to your household. With co-parents, the child may also be registered at the home address of one of the co-parents.

Young disabled discount

In 2022, the young disabled person discount will be € 771,-. You are entitled to the young disabled person's discount if you are entitled to a benefit under the Disability Provision for Young Disabled Persons Act (or: WAJONG benefit). If the right to the benefit exists, but you do not receive the benefit because of another benefit or other income, you are entitled to the young disabled person discount.

Elderly discount

You will receive the elderly discount if you have reached retirement age in 2022. The discounts in 2022 are as follows:

Table elderly discount 2022

Discount for green investments

This discount applies to everyone who invests in a green fund. No tax is levied on green investments. In addition to the exemption from tax on green investments, you are entitled to the discount for green investments if you invest money in a fund that has been recognized by the Tax authorities as a green fund. This discount amounts to a maximum of 0.7% of the amount to which the exemption applies in Box 3. Here you will find an overview of funds and investments to which a tax benefit applies.