Payment reference VAT-declaration

Maybe this sounds familiar; you want to pay your revenue tax (or VAT) to the Tax Authorities in time and correctly. However, when you want to transfer the amount, you can’t find your payment reference. Annoying, but luckily not a disaster. Lexlupa will explain how you can easily retrace your payment reference, so you can pay your revenue tax in time.

Receive or pay VAT

As an entrepreneur, you would usually pay VAT to the Tax Authorities. The procedure should be known to you: you pay VAT over your outgoing invoices (your income), and you get VAT back from your incoming invoices (your expenses). When the VAT-amount that you have invoiced is higher than the preload that has been billed to you, you will need to pay back the amount to the Tax Authorities. And, the other way around, when you pay more VAT for incoming invoices than you have received for outgoing invoices in a certain period, you will get the difference back. Paying or receiving VAT happens once per month, quarter or year, depending on the period in which you are obligated to do tax declarations.

Payment reference

When you make a payment for your revenue taxes, you will need to include your unique payment reference. This reference functions as an identification number for the Tax Authorities. Correctly including this number ensures that the Tax Authorities recognize the payment as your payment. When you do not include this number (correctly) the Tax Authorities may not recognize this payment as yours. Which means a lot of hassle for you.

Although every entrepreneur wants a payment to be correctly recognized by the Tax Authorities, not every entrepreneur has the correct payment information. The payment references are only provided by letter once a year. This letter is not always readily available when you want to make your payment. However, there is another way to figure out what payment reference you will need to include when paying your revenue tax.

Conversion Module

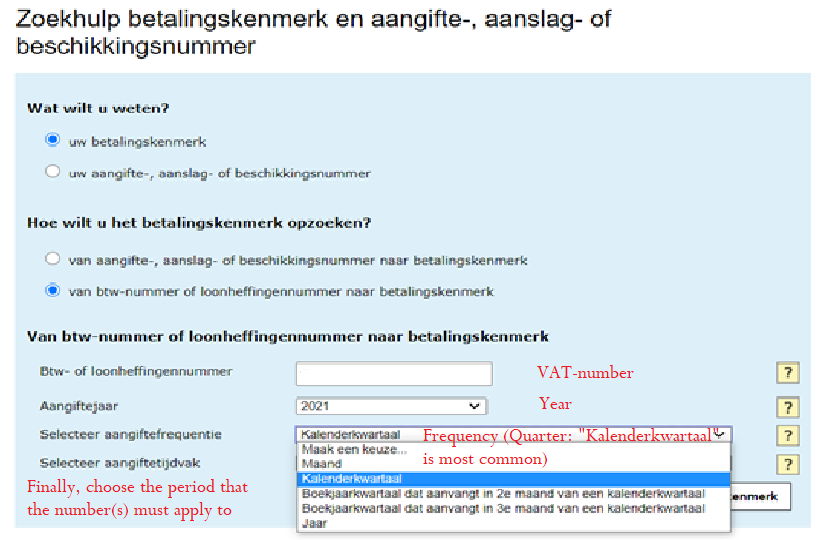

When you (no longer) have the declaration letter and therefore don’t have the payment reference, you can easily retrieve the payment reference number. You can use the conversion module (only in Dutch) of the Tax Authorities for this. Indicate you want to find out what your payment reference number is in the conversion module (the upper bullet: “uw betalingskenmerk”). Then with the second question, choose the lower bullet (“van btw-nummer of loonheffingennummer naar betalingskenmerk”). Then fill in your VAT-number (at “Btw- of loonheffingennummer”) and follow the steps of the module (we added the English terms –written in red- in the image below).

Please note

When considering the VAT-declaration of a private company (bv), partnership (vof) or foundation, you do not use your own fiscal number, but the fiscal number of your organization. This number usually starts with an 8. After that, you will need to add the concluding numbers of your declaration number. This number usually consists of 6 digits. It starts with the last two digits of your VAT-number (01 if this is your first VAT-number, 02 if this is your second et cetera). The last four digits of the concluding digits are dependent on the declaration period. This appendix has the concluding digits of the different periods of 2020 up until 2029.

Example

You want to figure out what the payment reference is of the declaration revenue tax of the third quarter of 2020. Your fiscal number is 1234.56.789 and your VAT-number is 1234.56.789.B.01. Enter your fiscal number 123456789. Choose the letter B (VAT). Enter the concluding digits: 017270. Then the module will give you the payment reference of the declaration for the third quarter.

Further information

You can learn more about VAT-payments and revenue tax for foreign entrepreneurs at the website of the Dutch Tax authorities. Would you like to know more about filing VAT returns and paying VAT? You can read this article. More information about which VAT tarif to apply on your invoices can be found here.